For the creator

Planning for the future

Wanting to maximize current earnings

Trying to be tax efficient

Needing one team for all their financial interests

Why affluence

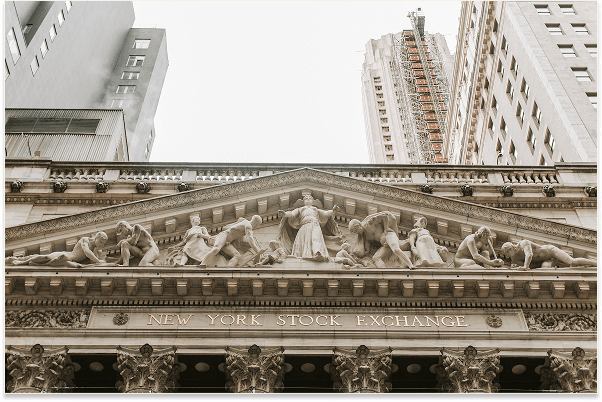

Creators are underserved & under allocated to long-term financial wealth generators

Only 35% of Americans own stocks, bonds, or mutual funds outside of retirement accounts. Many creators don't have retirement accounts

Enable creators to grow assets for the future while earnings are high.

Keep pace with rapid market changes & build long term wealth

Over the last 30 years, stocks have provided annualized return of 10.29% compared to 8.78% in real estate over the same period.

Help creators diversify away from other traditional assets.

Advisors Produce Better Results

A 2016 CIRANO study found households that used advisors accumulated 290% or 3.9 times more assets after 15 years compared those that didn't use advisors

Ensure creators are benefiting from accelerated market growth.

About us

Full story

Creator finance content

Diversification. Why Investing is Similar to a Creator's Income Streams.

Last week we talked about growing your money. This week, we talk about protecting it.

01/23/2026

Compound Interest Is A Creator's Best Friend.

Why a creator front-loading their investments gives them a massive advantage over their peers.

01/16/2026

Why Creators Will Thrive in an AI World.

Block out the noise. An economic take on why content creators shouldn't fear the rise of AI.

01/12/2026

If the Ultra Rich Use Wealth Managers. Shouldn't You?

The US economy is unapologetically capitalist.

12/19/2025